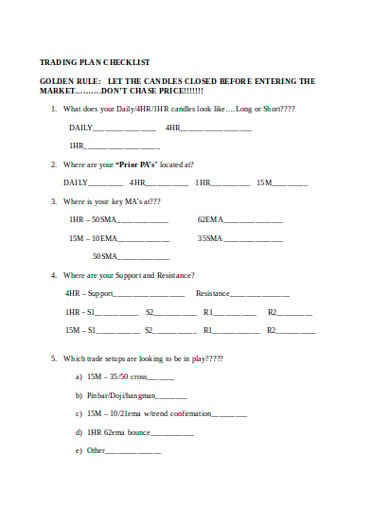

Business Plan The business plan is a set of formal business goals and a proper plan to achieve those goals. The plan explains and the mission of the company including all the products or services offered, the complete market analysis, sales forecasts, competitions and financial statements in order to show the strength of the plan. However, the most important tool required for trading success is a good, solid business plan. There is a saying: “Without a plan to win, you automatically plan to fail.” Compare trying to trade without a “goal” to a soccer team playing without a goal or a net to put the ball in for a score. Alter your trading plan. But you still have a plan. The difference between the winning traders and the losing traders is a plan. If you have a good plan (developed over time) and you stick to it, you can become successful! You may have a simple plan or a complex plan but to be successful you need to FOLLOW YOUR PLAN. Basics For Your Plan.

2021 UPDATE: Read my guide to the Best Trading Journals tips on how to successfully maintain your journal.

Trading Journal Spreadsheet Download

I’ve had quite a few requests for a copy of the spreadsheet I use for my trading journal. I uploaded it to the server so feel free to download a copy if you’re interested. It’s not the most elegant spreadsheet but it does what I need.

Here’s some details about the columns included:

- Expectancy: An average of column K (R Multiple). This formula must be modified each day to include the latest rows.

- Total P&L: Sum of Column J (P&L)

- Trade #: Just used for some calculations later…

- L/S: Long or Short

- QTY: Number of shares

- Bought: Purchase price

- Sold: Selling price

- Initial Risk: Dollars at risk based on the initial stop

- Comm: Commission for both sides of the trade. I have it set to calculate based on the number of shares entered in column E.

- P&L: The actual P&L, including commission

- R Multiple: P&L divided by the Initial Risk

- % Wins: This is calculated by dividing column R (Sum W/L) by column A (Trade #)

- Comments: I use this to list errors made on the trade or anything else worth noting.

- $ at Work: This gives me an idea of how much money was in the position. It’s simply QTY (column E) divided by Bought (purchase price). Note that this is not accurate for shorts but it’s close enough for government work. 🙂

- % P&L: The percentage return for the trade. P&L divided by $ at Work. Again, not exact for shorts.

- Initial % Risk: Just tells me how far my stop was from my entry in percentage terms.

- W/L: Tells whether the trade was a winner (1) or a loser (0). This is used by the next column, Sum W/L.

- Sum W/L: A running total of the W/L column. This is used in the % Wins column.

Have ideas for how I can improve the spreadsheet? Email me!

2021 UPDATE: Read my guide to the Best Trading Journals tips on how to successfully maintain your journal.